Frequency Analysis #13: War Prophet, Cyber Appeals and AI Attention

Two things you can count on to always change are technologies and seasons. The dynamism is built in from the start. Constant change, is an oxymoron like military intelligence, political correctness or artificial intelligence. That theses concepts contain their own destructive force is deeply unsettling and elucidating. To paraphrase Warren Buffett, "Look around the poker table; if you can't see the [oxymoron], you're it."

Geopolitics

The major news is still, as it should be, Israel and Gaza. I don't intend to weigh in much on this topic, since it's outside of my area of expertise, and there's plenty of noise out there. Over on the other side of this site, however, I've been writing about war and progress, so I thought I would share the thought that has stuck with me the most over the past week and a half:

Overrated lens’ from which to examine conflict:

— Jeremy Giffon (@jeremygiffon) October 7, 2023

- economic

- political

Underrated:

- prophetic

- spiritual

In other global news, reports of the death of the dollar are greatly exaggerated. Here's a story about India pushing back on Russia's demands to pay for oil in Chinese Yuan. In 2022 Russia's attempt to make Europe pay for gas in rubles failed, but they were able to skirt Western sanctions by shipping oil to India and other partners. It is interesting to note that Russia has switched its tactic to asking for Yuan, after complaining about the rupees piling up in Russian banks. India's tenuous relationship with China has them pushing back, but since Dollars and Euros aren't on the table, there are few options left.

Similarly, the U.S.- China trade ware is putting chip manufacturing countries in the middle of the conflict. U.S. export bans on chips and manufacturing technology to China is having an effect on the U.S., South Korean and Taiwanese semiconductor industries. Watching the chip war play out will be interesting, particularly as supply chain risks and AI continue to be hot topics of discussion.

Technology

New DDoS attack, new record, as Google Cloud fights off a 398 million requests per second on Wikipedia. Little information has been released so far, and no attribution has been made, so we don't know much except that DDoS will always be with us and as more compute comes online, new records will be set. With all of the AI compute that is about to come online (if developers can get the chips that is!), we should only expect this problem to continue to grow.

Here's a great and pretty short read on how AI will help both cyber attackers and defenders. The piece (disclosure, the author was my professor) argues that AI brings hope to cyber defenders for the first time in a while. Talent and time constraints have held back defenders for much of the fight, and automation promises to even the odds, but attackers can automate too. The opportunity for defenders, however, is a difference of kind, not degree. While attackers can use automation to scale their attacks to astronomical new levels, defenders are enabled with a whole new approach to managing scale and complexity, two challenges that have always plagued defense and automated intelligence is particularly well equipped to deal with.

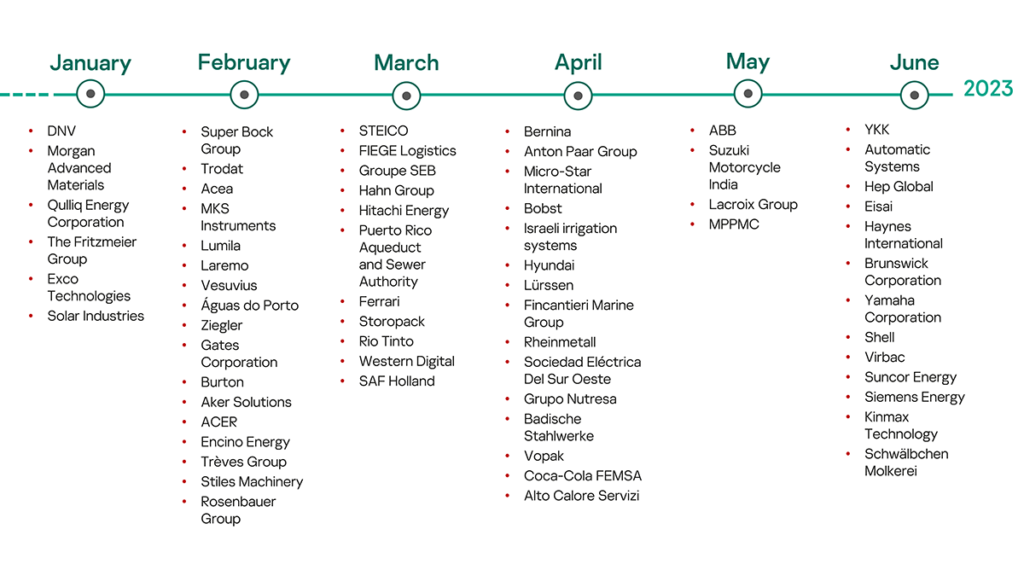

Slightly less hopeful is a look at today's industrial infrastructure (much of it is really yesterday's infrastructure hanging on for dear life) and cyber defense. Kaspersky's ICS lab has a good overview of how things went in the first half of 2023. Timeline below:

As risk professionals and investors think about the possible advantages and disadvantages changing technology will bring, they should not only consider the implications for IT and OT, but also the regulatory environment.

Uber's former CISO is appealing his conviction over the 2016 breach coverup. This landmark case is a bellwether for CISOs and an industry that, unsurprisingly, has always been risk averse. One industry without that level of risk aversion has been cryptocurrency, which you'll be shocked to find out has some level of allegedly unethical business practices. Consensys founder Joseph Lubin is being taken to court by his former employees.

Finance

Sticking with cryptocurrency just a bit longer, here's an interesting look at how Hamas was able to finance its attack. There will, no doubt, be much introspection about the failure of intelligence, but it is interesting to note how quickly technology enabled people to follow the money. Why it was not a warning sign is an interesting question for intelligence analysts to ponder.

In more crypto laundering news, check out this fascinating piece on a bitcoin for cash ring operating as an unlicensed money transmitter in New York. With so much focus on AI right now, you might think that DeFi is suffering through another cryptowinter, but bitcoin is up 50% on the year and crypto startups are being funded. Maybe a little less attention on crypto is just what the market needed.

With all the fervor on AI, it's no surprise that SEC Chair Gary Gensler would weigh in on AI risk to financial markets. Between regulation and supply chain risks, AI may face a difficult winter of 2023-2024, but spring inevitably comes and those who plan to survive long enough will reap the benefits.