What a Piece of Work... Cont'd

As promised, this week we complete the analysis of the most prominently stated manmade causes of stagnation. Last week explored underfunding of public goods and inequality, while this week deals with rentier capitalism and government overreach. The conclusion of "What a Piece of Work is a Man" warned against the temptation to pin the complex problem of stagnation on any one person or group. Instead of pointing the finger, this exercise is an effort to identify areas of greatest importance and opportunity so that we can make progress again.

The areas of public goods and inequality, discussed last week, are essentially arguments that the economy is misaallocating resources, either by not spending enough on infrastructure, science, defense, etc. or by poorly distributing the gains of wealth equally throughout society. The inverse of this line of reasoning is to ask, "Who is getting too much?" In this week's piece, I hope to describe two answers to that question and make a suggestion about the whole category of manmade causes, but first we pick up where we left off, with the perverse effects of inequality.

Rentier Capitalism: The Rent Is Too Damn High

In 1879 Henry George published Progress and Poverty to explain how, despite the increase in wealth and advances in technology, poverty continued to plague society. The book was one of the best selling of the century and went on to be praised by the likes of Winston Churchill and Albert Einstein. Joseph Stiglitz and other modern economists are just reviving the once most widely held economic belief in America. Economists point to more than just land as rent extracting surplus value above the owner's cost of production, however. Monopoly profits, natural resource extraction and intellectual property licenses are all examples of modern rents that hardly existed in George's time.

The late 1800's were marked by three phenomena, the Gilded Age, the Victorian Era and the Second Industrial Revolution. The Gilded Age's most salient feature is inequality, discussed above. The Victorian Era's most salient feature is moralizing, which gets to the psychological/spiritual causes later in this series. The most salient feature of the Second Industrial Revolution is the trust company. George lived in a period of great technological advancement (railroads, steel, skyscrapers, telephones, and electricity) but also an era of the natural monopoly.

The ethical and practical problems of monopolies get most of the attention when discussing rent-seeking, but let us focus on the implications for growth. As cited above, Stiglitz makes a compelling argument that rent extraction is crippling growth. Rent seeking investments crowd out capital formation and accelerate inequality, which creates a drag on growth through reduction of consumer welfare and political capture. Not only is there a crowding-out effect of capital, but monopsony (labor monopoly) also creates a crowding-out effect of talent. Put another way:

The best minds of my generation are [trying] to make people click ads.

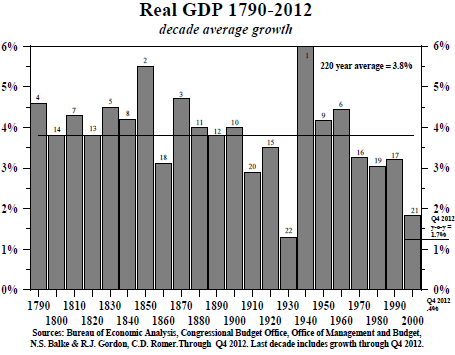

It's hard to discount this argument, particularly when we also live in an age of natural monopolies (telecom, semiconductors, operating systems, search and social media). That may be where comparison to the economy of the Gilded Age ends, though, because when you examine the growth numbers, you see that real GDP was over 3.75% on average from 1870-1910. Growth did slow in the following three decades, possibly due to the trusts, but WWI, the Great Depression and WWII surely also contributed to slow growth.

The discussion of rents got new life in the 1980's with Nobel laureate James Buchanan's public choice theory, which emphasized special interest groups, lobbying and regulatory capture in rent-seeking (a theme we will return to when addressing cultural reasons for stagnation). If we're going to seriously consider the idea that monopolies are causing slow growth, let's take a look at a counter argument in favor of monopolies:

In a static world, a monopolist is just a rent collector.... But the world we live in is dynamic: We can invent new and better things. Creative monopolists give customers more choices by adding entirely new categories of abundance to the world. Creative monopolies aren't just good for the rest of society; they're powerful engines for making it better....

The dynamism of new monopolies itself explains why old monopolies don't strangle innovation. With Apple's iOS at the forefront, the rise of mobile computing has dramatically reduced Microsoft's decades-long operating system dominance....

Monopolies drive progress because the promise of years or even decades of monopoly profits provides a powerful incentive to innovate. Then monopolies can keep innovating because profits enable them to make the long-term plans and finance the ambitious research projects that firms locked in competition can't dream of.

In his WSJ opinion piece Competition is for Losers (excerpt above), Peter Thiel asserts that monopolies are not a drag on growth, but a reason for innovation – at least creative monopolies are. What makes something a creative monopoly isn't exactly clear, but he hints at one definition that does open the possibility of synthesis between the two sides. One definition of a creative monopoly is a new monopoly.

While the discussion above makes a passing mention of land before turning to the broader economic rent, let's return to the simple example of land as a kind of archetypal monopoly. Each plot of land is unique in its innate properties and relative position to other plots of land. There is no substitute, because, as they say in real estate, "location, location, location!" A creative monopoly in real estate may be either land reclamation or new development, both of which are often strongly opposed on environmental and sustainability grounds.

There are other reasons people do not want novel and creative land use, from worries about gentrification, character and aesthetics to more self-centered NIMBYism. Investor Marc Andreesen's wrote the viral, It's Time to Build blog post and within two years was exposed as an opponent of building in his neighborhood. There are many reasons to oppose building, but what are the costs?

Enrico Morretti, an economist specializing in labor and urban economics, quantifies them in his paper Housing Constraints and Spatial Misallocation with development economist Chang-Tsai Hsieh. They find that the total "US GDP in 2009 would be 8.9% higher" if the price of housing had stayed comparable to 1964 and that housing "constraints lowered aggregate US growth by 36% from 1964 to 2009. These numbers are so large that, if true, they could explain nearly all of stagnation and inequality without resorting to definitions of monopoly that extend to telecom, airlines and health insurance. This theory is so popular with the founder of Works in Progress, an online magazine dedicated to underdog ideas about progress, that they wrote The Housing Theory of Everything.

So why aren't we creating, building and doing more? Have we simply run out of land? Is it just really hard to do something new? Or, as John Myers, Ben Southwood and Sam Bowman propose, is regulation simply too burdensome?

Government Overreach: Very Fallible Judgment

Here I have lumped three free market critiques of our economy under the rubric of government overreach. The three often cited tenets of fiscal conservatives (or liberalism, if you prefer) are less regulation, lower taxation and limited government. Milton Friedman's Why Government is the Problem sums it up nicely. While the rentier capitalism argument emphasizes only the regulatory issue the broader critique, as Friedman proposes, is that governments always attempt to stifle growth.

There are, however, glaring counter examples of government policy successfully encouraging growth, most notably in East Asia, and a long history of ebbs and flows of industrial policy in the United States. Economist Robert Wade argues that throughout US history, from Alexander Hamilton's Report on Manufacturers to Abraham Lincoln's Pacific Railway Act and Franklin D. Roosevelt's New Deal policies like the Rural Electrification Act, we have always been a developmental state in disguise. These arguments hark back to the very first manmade cause we discussed in last week's piece; underfunding of public goods. In that piece I focused more on the R&D aspect of public goods, but the same argument applies to infrastructure, critical industry and defense. As compelling as this case may be, there are good reasons to share Friedman's reservations.

International trade and economic development economist Jagdish Bhagwati, (disclaimer: he was professor of mine in grad school) handily compiled and then dispensed with each argument in a 1996 speech, concluding that countries "grew fast despite [their] industrial policies, than because of them." He does not completely discount the role of government in jumpstarting growth out of a low investment trap, whereby government can catalyze the creation of capital stock, but he points out that returns to that strategy are limited and must be followed on by private sector action. This is the very action that government intervention is likely to smother.

While limited government and industrial policy seem to have been fought to a standstill by economists, public opinion has shifted sharply in favor of government action. The recent framing, as competing with China rather than raising US productivity, is summed up well by the fiscally conservative Peterson Institute:

A surge of industrial policy during the Biden administration seems inevitable. Brian Deese, director of the White House’s National Economic Council, has called for aggressive industrial support both to reduce supply chain vulnerability and to compete with China. In the wake of pandemic relief that has expended some $3 trillion of public funds to afflicted families and firms, public acceptance of “big government” runs high. Recognized scholars endorse the new mood, though with caveats. Of course, support for “big government” is not a prerequisite for industrial policy: witness episodes during the Reagan administration (no fan of big government) and multiple episodes in conservative southern states. Even so, in 2021 a deeply divided Congress has signaled strong bipartisan and bicameral support for legislation following Deese’s prescription: compete with China and ensure the security of supply chains, as summarized in table 5.3. Tolerance for major public spending provides a tail wind for industrial policy projects. Nevertheless, budget realities and private opposition will ultimately impose limits.

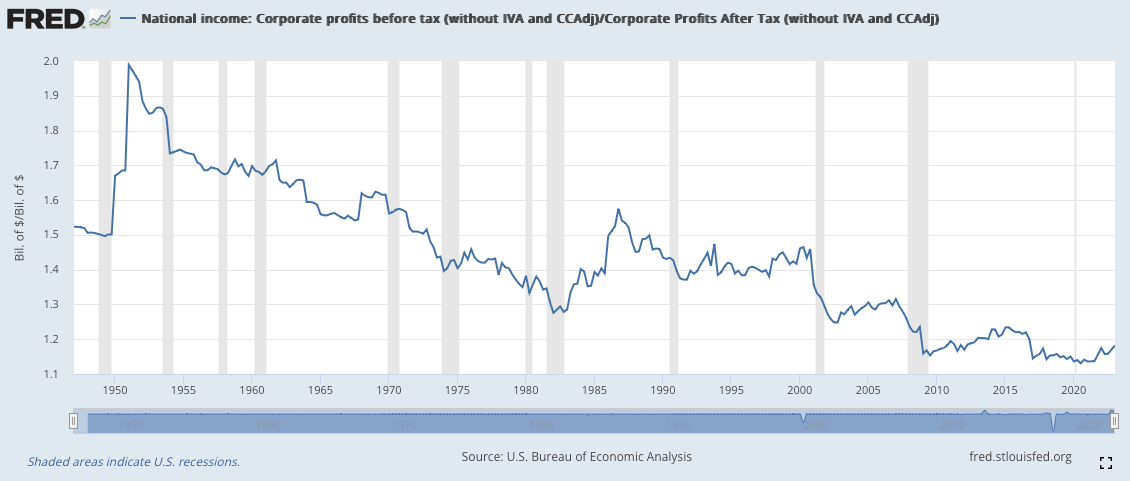

If government intervention and industrial policy is a draw in theory, but resolved in practice, tax policy is resolved in theory, but a draw in practice. While there is no shortage of policy papers demonstrating the loss to society of taxes, there remains a vibrant debate, particularly about corporate and high income brackets. Still, tax cuts are also criticized for their lack of economic benefit. Economist Greg Mankiw, former chairman of the Council of Economic Advisers under President George W. Bush, wrote in 2018 that tax cut proponents "seem to believe that this growth will follow ineluctably from the lower taxes and deregulation." Furthermore, historically high taxes in America coincided with high growth, which is not to say high taxes cause growth, but that we should be looking for more nuanced answers. As commentator and Matthew Yglesias points out the "story about taxes and output is a story about levels not growth rates."

So that leaves us with regulation, the most plausible and most challenging of the three culprits to address. For one thing, does regulation slow growth or can deregulation also slow growth? Take, for example, the financial services sector. Economist Hyman Minksy's eponymous Minksy Moment became a meme following the Great Financial Crisis. Informed by direct experience as a board member of a regional bank, Minsky drew on his experience to develop his alternative perspective. Minsky argues in Global Consequences of Financial Deregulation that, unlike orthodox economic models that rely on static or dynamic equilibria, his models demonstrated inherent instability in the financial sector. If this is the case, then regulation plays a role in reducing tail risks, that is, low-probability, high-impact losses, such as financial crises.

Each regulation, therefore, must be examined, not for its known costs but also expected value or as insurance calls it, loss exceedance. Giving up some short-term growth to stave off disaster is exactly the type of market failure governments can address. Still the evidence is strong that at least some types of regulation have significant costs.

Licensing and permitting, as standard economics describes, impose artificial scarcity. The origins of occupational licensing, building permits, copyright and patents comes from explicit monopoly granted by royal permission. Today there is evidence that licensing and permitting in the United States costs the economy nearly $200B annually. Measuring and reducing these costs, however, is challenging because many of the most pernicious regulations are local and state. One study found that the effects of federal regulation on business dynamism are negligible, and at the same time we know that zoning and building codes increase the cost of building which adversely affects housing, energy and labor markets.

Besides permitting and licensing, there are all manner of compliance requirements across sectors that spawn rules and bureaucracies, creating perverse incentives. In Utopia of Rules, iconoclast anthropologist David Graeber, offers a left-wing critique of regulation that is often overshadowed by the free market version espoused by economists, business lobbying groups and investors. He makes a convincing case that regulation and bureaucracy is at least as much a problem of the corporation as it is of the state, which anyone who has had to deal with banks, airlines, telecoms or insurance companies can attest. We will save the rest of this argument for a discussion of cultural causes of stagnation and return to the economic argument.

One politically polarizing area of regulation is the environment. In 1970 Richard Nixon created the Environmental Protection Agency. On top of the licensing costs mentioned above, EPA's own estimates show that environmental regulations add another $200B in annual costs. Environmental regulations are a tempting target for two reasons. First, they are among the most restrictive of any regulators, and second they are primarily implemented at the federal level, making their controls more salient. There is, however, a reasonable counter argument. The benefits of environmental regulations outweigh the costs, as proposed by in this paper examining the undercounting of environmental costs. It is a commonly made argument that the growth of the 20th century was overestimated because of hidden environmental damage and our current growth is underestimated. We will save that discussion for the cultural causes as well.

There is much more that can be said about regulation, and the arguments that government either isn't doing enough or is doing too much, but these broad gloss statements seem destined to remain unresolved. The economy is nuanced and growth is unlikely to respond to such clumsy assessments. I'm not sure what can be concluded about government's role in growth except the obvious, which is that competent government can promote growth.

To Tell My Story

Shakespeare buffs will have recognized the title of this piece as a line from Hamlet's famous monologue. The phrase is spoken with the awe at magnificence of man, irony at our ability to do evil and sincerity as Hamlet investigates the essence of humanity. Ultimately the monologue ends in disgust and disinterest claiming man is just dust. Hamlet is famous for equivocating, indecisive melodrama, a post-modern phenomenon in an age when we know better than to seek revenge, but still long for someone to blame and a satisfying resolution.

The four arguments for manmade impediments to progress are all appealing, but we should hesitate and examine the consequences of hasty retribution. The question of too little or too much government is a distraction from the importance of good government, but promotion of good government is a truism. The question of inequality may or may not be important to growth, but growth is inextricably tied to the reason for that inequality, which in turn, is related to the question of what to do about profitable, but unproductive investment. The nested nature of these questions again echoes Hamlet. In an effort to elicit a confession of murder from his uncle, the unhappy prince creates a play called The Mousetrap. In attempting this political theatre to expose the murderer he exposes his own biases and is no closer to acting to resolve his problems than when the play began.