What a Piece of Work Is a Man

Progress has four potential enemies: man, nature, society and self/god. Last week's piece Stagnation and Skandalon laid out these adversaries and the potentail ways in which they challenge economic growth. This week we begin with the most popularly cited enemy of progress, man.

First, a brief apologia for use of the generic word "man," not human or people. One reaction to my choice may be that it is sexist, but the man we are discussing here is the enemy of, not the advocate for, progress. Can other genders not be villains? Of course they can. So why the ambiguity? Partly because a single syllable is preferable and partly because the ambiguity is useful. The more specifically male-biased mental image may help us to visualize an individual to blame. When we do visualize such a person, try again with different traits and see how the arguments feel aimed at such a person.

The category of manmade stumbling blocks for progress is the most political of the four, and as mentioned above, the causes may be embodied in an individual or type of person who we wish to blame for lack of progress. This feature makes these arguments popular in opinion pieces, public media and debates. The advocates for some of these arguments are often the loudest, frequently the most bombastic and rarely falsifiable. Depending on one's political persuasion, identity group and prior beliefs one or more of these arguments may be particularly appealing. There is likely some truth in all of them, but that can be said of all of the previously mentioned causes of stagnation as well. Our goal here is to discuss the merits and identify the areas in which progress can be made, not simply to deplore the cause.

With that in mind, here are the four main economic arguments I often hear as to the slowing of economic growth. First, is the under funding of public goods. Second, is inequality. Third, is rentier capitalism. Four is government overreach. You may notice that the first and fourth arguments are diametrically opposed ("government isn't doing enough" and "government is doing too much") The second is a more complicated argument invoking circular logic and the effect of wealth on political institutions ("blame the rich"). The third focuses on particular sectors that have avoided the slow down ("blame the banks" or "blame social media" or "blame the landlords"). To assess each of these, let's briefly discuss the main arguments and some critiques, withholding judgement until the end, when we can return to the category as a whole to determine whether the specific arguments have made the economic argument more or less compelling as a cause of stagnation.

Underfunding Public Goods: A Common Tragedy

First up are, public goods, or a parable about the tragedy of the commons. Public goods are non-rival (consumable or possessable by a single person) and non-excludable (difficult or impossible to restrict access to them). National defense is often cited as a prototypical public good, along with lighthouses and law enforcement. For more about the theory, definition and examples, see this module by June Sekera, a Research Fellow at the Global Development and Environment Institute (GDAE) at Tufts University. There are two flavors of this argument, one focusing on research and development (R&D) as a public good and the other focusing on social coordination and distribution of public goods in general.

The basic premise of the R&D argument is that progress and productivity growth is made possibly by commercial application of scientific knowledge through technology. If basic science research, unquestionably a public good, is slowing down, then technology will necessarily slow down as a result. Many argue (as James Pethokoukis does here that lack of federal funding in R&D is the problem. This is a favorite argument of venture capitalists, like Josh Wolfe of Lux Capital, who are at the forefront of commercializing R&D. There are less statist variations on this argument bemoaning the lack of corporate research labs, a benefactor of the post-war era, just as there were aristocratic patrons in Kepler's day and foundations today. There is even a meta-argument to fund a Science of Progress. As much as I would like to be compensated for this writing, there are a few areas of pushback that we should consider.

The main reasons to be wary of the funding debate is not that science is bad. Who could be against more science? The main reasons are about efficacy of funding. Let's question three basic assumptions: money for research has been falling, more money produces more science and scientific results produce technological progress.

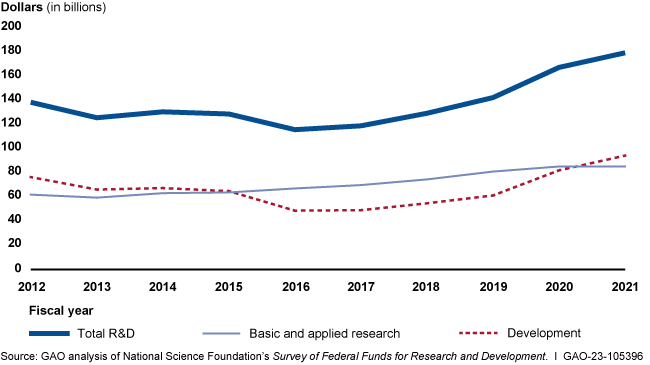

Most basic science research in the United States (the world leader in funding) is conducted by the DoD, HHS, DOE, NASA and NSF through a network of universities, national labs and non-profit research institutions. While it is true that the private sector began to provide most of the funding for R&D in the 1980's, and that federal funding as a percent of GDP has declined from its peak, that does not mean that gross funding has fallen. In fact, funding has risen since the decline of growth in the 1970's. The argument, however, has been so well recieved that the Biden administration's IRA and CHIPS acts have catalyzed funding in energy and industrial policy. If this shot in the arm generates quick results, I may be able to conclude this series shortly, but there are many reasons to skeptical of this claim.

The hope of more funding rests on the claim that more funding will create more science. This is close enough to two other arguments, the "low-hanging fruit argument" and the "corruption argument," that I will save most of the investigation for later in this series. Another argument blames not the amount of funding but the cumbersome institutions that distributes the funding. This is similar enough to the "breakdown of meritocratic institutions" argument, which will be addressed later as well, but deserves a word here first. In the popular book Where Is My Flying Car?, author J. Storrs Hall coined the term the "Machiavelli effect" to describe how incumbents benefit from stasis and the future beneficiaries of novelty can't or won't organize to bring about change. In Hall's assessment, an influx of public funding creates perverse incentives for corrupt leaders to manipulate institutions for their own benefit, ultimately killing off the funding. I am pointing this out now to demonstrate that these categories are not mutually exclusive and we will return to this topic at the appropriate time.

Still, it is useful to investigate the public goods hypothesis to it's logical end and question whether the bottleneck is funding, research or development. Assuming adequate funding and a functioning research system, there is evidence that commercialization, particularly in healthcare, is the main impediment to technological progress. We should note that defense R&D is about twice that of healthcare, which is twice that of energy. Since much of defense R&D is heavily tilted towards applications, R&D numbers skew in that direction. The private sector, has poured money into applied R&D as well since the 1980's with a marked uptick in the last decade. This is in part due to tax benefits from classifying expenses as R&D (the result of a 1981 law) or more charitably, the policy successfully encouraged more private R&D. If more private R&D resulted in greater progress, there would be little debate at all, but more money has not yielded greater progress, and perhaps we should view more R&D spending with tepid growth as evidence of slowing progress.

I have been fairly loose about R&D terminology so far and avoided the exact definitions of basic science, development and application, as well as the accounting criteria that qualifies spending as R&D. This debate warrants more effort from economists, but I'll leave it here with a final thought. Scientists, industry and policy makers can all blame previous politicians for lack of funding. They all stand to benefit from increasing funding. Who should we believe about how much funding is adequate and whether the results warrant the investment?

Ending with a social question, not a hard finance or science question is unsatisfying, but it does bring us to the broader second flavor of the public goods argument; the question of social coordination and distribution. Non-rival and non-excludable goods are everywhere once you start to look. Our hospital system, for example, may have a limited number of beds at any given time, but mostly one patient does not consume a bed and our social norm is to offer (emergency) medical aid to anyone who needs it. Then there are goods that are either non-rival, like concerts or non-excludable like clean water. We call these club and common-pool goods respectively and they share some of the same difficulty of public goods. Their benefits are diffuse, but their value can be more easily captured by certain groups. Public, club and common-pool goods can all be exploited by manipulation of the political system, since markets fail to allocate these resources efficiently. The question of the failure of our political system is another causes célèbres, but one that I will address in the societal category at a later date.

Inequality: First Among Equals

Let us turn to the second argument, that inequality is at the root of our productivity slowdown. In my list of hypotheses I claimed that "growth created inequality and that inequality is bad for growth," but there are a few claims to disentangle here. Inequality may not be the result of growth and inequality per-se may not be bad for growth, but it is also possible that lack of growth created inequality.

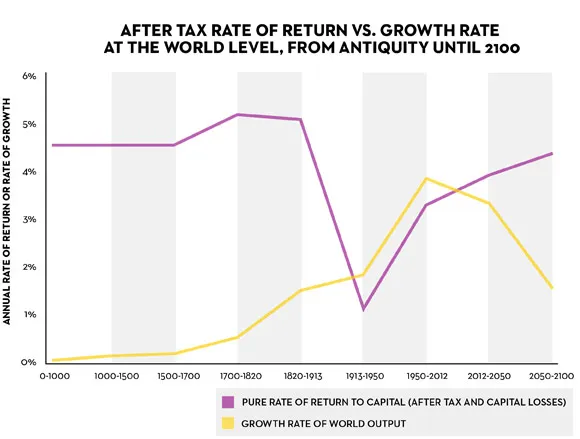

Lack of growth created inequality is author Thomas Piketty's argument in short. We can return to the idea that growth necessarily creates inequality later because if growth reduces inequality, than those concerned with inequality will also be interested in growth. Piketty's foundational claim is simply that if the rate of return on capital is greater than the growth rate of the economy, then wealth will accrue to capital faster than to labor. According to Piketty, the equality we enjoyed in the middle of the 20th century was an aberration marked by destruction of capital from wars and The Depression followed by a period of high growth that allowed for increasing median wages.

Piketty is skeptical that progress is an output and believes we are fated by the "caprices of technology" to live in periods of high or low growth. He does not see a direct relationship between inequality and growth, except through politics. Piketty has been criticized by many who are also concerned with inequality, such as Joseph Stiglitz.

Stiglitz claims that Piketty overestimates inequality in his accounting of capital. Piketty fails to account for the drastic increase in the price of land, which skews his wealth numbers. Since there is a fixed amount of land as opposed to capital, which can be created, Stiglitz demonstrates that the rise in inequality is largely due to the rise in the price of land and other monopolistic assets. Why does this distinction matter?

Stiglitz lays out a convincing case in Inequality and Economic Growth that even as median wages stagnated and economic growth slowed, returns to capital accelerated. His main culprit is rent, which he extends not only to land, but any investment activity which is unproductive. I'll focus more on that argument in the section next week, but let us return to inequality. According to Stiglitz, inequality is bad for growth because of over-investment in unproductive areas and the political advantages afforded the wealthy. Inequality is a product of the former, but a cause of the latter. If inequality is a result of slow growth, we're back to Piketty's case and if inequality wrecks political institutions the problem is a social one that we'll discuss later, but what if inequality causes slow growth more directly?

Economists from Robert Barro to Branko Milanović have failed to demonstrate a stable relationship between growth and inequality across countries and time. Since at least 1955, when Simon Kuznets made famous the Kuznets Curve, economists have tried to prove the theoretical frown the Kuznets postulated to describe the low inequality in both very low and very high income countries. Barro claims that inequality may actually improve growth in wealthy countries and Milanović suggests that the lack of empirical evidence for a sustained relationship is caused by new waves of technology that upset the existing equilibriums. Whether inequality is cyclical or inconsistently correlated with growth, the evidence that inequality causes slow growth is thin.

If inequality itself is not bad for growth, but may have perverse effects on rents and politics, then the question of inequality is a social one, not an economic one. If however, growth is exogenous and inequality is an inevitable outcome of capitalism, then the pursuit of growth is foolish. I admit that my original list of causes had only considered that growth was bad, not that it was predetermined, but this argument likely pairs well with other nihilistic arguments in the psychological/spiritual category. Next week we will continue our efforts and more closely examine the perverse effects of inequality such as investment in unproductive assets when we discuss rentier capitalism and government overreach.

To Be Continued...

Here we will pause before picking up the second half of the manmade causes of stagnation. To summarize, the four reasons discussed at the top were:

- Underfunding

- Inequality

- Rentier Capitalism

- Government Overreach

The two discussed above, underfunding and inequality, tend to be popular on the left of the political spectrum and the remaining two more popular on the right. The introduction of this piece took a brief tangent to discuss the role of identity and politics in suggesting a manmade cause of stagnation. It is worth considering the role of responsibility precisely because it is too appealing an argument. If stagnation were in fact the fault of one person or type of person, the problem wouldn't be nearly as intractable. With this in mind, we'll move forward next week by completing the analysis of manmade causes, towards the ultimate goal of identifying areas where progress is possible.