Frequency Analysis #10: Bottlenecks, building automation hack and Baltic unicorns

Here's a paper via Marginal Revolution and Alexander Berger by Ian Dew-Becker on Tail Risk in Production Networks. I'm obligated to post about it here, but it really is a great paper on the ripple effect of technology shocks in an economy. It's a paper about macroeconomics and how shocks to a firm's inputs can affect GDP, but the take aways have wider implications.

what determines tail risk is not whether there is granularity on average, but whether there can ever be granularity – whether a single sector can become pivotal if shocks are large enough.

For example, take electricity and restaurants. In normal times, those sectors are of similar size, which in a linear approximation would imply that they have similar effects on GDP. But one lesson of Covid was that shutting down restaurants is not catastrophic for GDP, whereas one might expect that a significant reduction in available electricity would have strongly negative effects – and that those effects would be convex in the size of the decline in available power. Electricity is systemically important not because it is important in good times, but because it would be important in bad times.

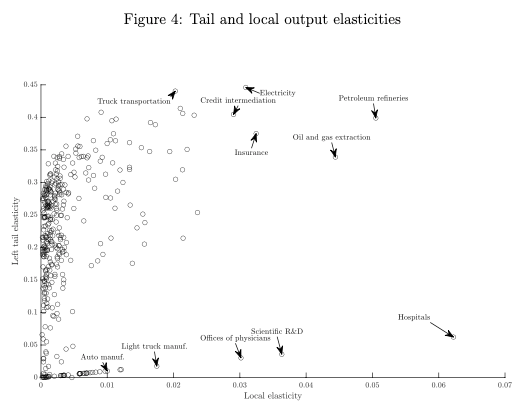

Below is a chart from the paper that looks at the importance of a sector to GDP in good times (the x axis titled "Local elasticity") and in a crisis (the y axis titled "Left tail elasticity").

High elasticity sectors can be thought of a bottlenecks in the economy, critical infrastructure, if you will. For more, check out economist John Cochran's review here.

Technology

One of the biggest building automation manufacturing, integration and services companies, Johnson Controls (JCI), was hit with ransomware this week. After getting hit last weekend through a IT systems in Asia, a number of subsidiaries are still down. JCI is one of the big automation manufacturers that is a supply bottleneck to many sectors, but because of the long life of the assets and their after market relationship with customers, it is also a threat vector. Supply chain risk has come to mean both cyber risk through vendors/partners and procurement risk. Often, the root cause of both these risks are structural economic issues.

Competition works to consolidate a market and innovation to distribute a market. As the saying goes, "there are only two ways to make money in business, bundling and unbundling." OpenAI is in talks with hardware designer Johnny Ive to discuss making a phone. Ben Thompson's Stratechery has a nice breakdown of how AI and virtual reality are drafting off one another to unbundle the media landscape as we know it. ChatGPT's ambitions to unseat search as the primary way humans organized the world's information isn't a head on assault, but a picking apart of use cases like searching for code, looking up travel plans or finding content summaries.

There's more in the post about Meta's announcements for its latest glasses and improvements to the next iteration of virtual reality. Ben Thompson writes, "True virtual reality shifts time like media, place like communications, and, crucially, does so with perfect availability and infinite capacity." Time and space have been physical bottlenecks for society for as long as coordinated behavior has existed. One way we've dealt with financial shocks is to spread them out using financial tools like debt and insurance.

Finance

Recently Ted Seides, host of the Private Equity Deals podcast, had on private equity MD Chris Ackerman to discuss the acquisition and sale of TigerRisk. TigerRisk is the fourth largest reinsurance broker in the world after the big three (Aon, Marsh and Gallagher). The deal happened to work out extraordinarily well for the investors and is a good example of how patience and persistence with a good idea can offer huge upside if you hit the timing just right.

With insurance markets hitting a period of low capacity and high prices, many are expecting a shakeup. Artemis.bm has a story about how long these conditions will last, but it's anyone's guess. The contradiction of high prices and persistently low supply isn't unique to insurance right now. The same phenomenon is being experienced by the housing, venture capital and private equity more broadly.

One firm that isn't having much trouble raising private equity funding is Nord VPN. They just raised $100M from Warburg Pincus at a $3B valuation. Nord is one of a handful of Baltic unicorns (others have included Skype, Spotify and Transferwise). As a group of small former Soviet countries that share borders with Russia, it wasn't obvious in 2012 that Nord would be a large company. In fact, they bootstrapped the company for ten years before taking any outside capital. But being close to Russia may have played in their favor as they have been exposed early to privacy and security concerns on the internet. When people first got online the internet was disorganized and peer to peer. Increasingly the internet has bottlenecks that provide opportunities for companies and governments to observe and control activity online. Nord helps people avoid targeting by obscuring your traffic or routing around bottlenecks.

Geopolitics

In the great power game China has been trying to build their own overland trade network with the belt and road initiative. Controlling trade routes has long been a geopolitical strategy and the easiest way to do that is to create bottlenecks. During Biden's recent trip to the Middle East he announced an alternative to Eurasian trade network with India and Middle Eastern participants. There's even talk of using the same network or roads and rails to provide digital and electrical connectivity, showing just how critical digital infrastructure is becoming to our lives.

Two big digital infrastructure players in the semiconductor space are NVIDIA and TSMC, both of which have been in the news a lot lately. NVIDIA recently made headlines when its French offices were raided in a mounting antitrust case. The talks with TSMC is around its struggles with the much touted Arizona fabrication facility. More delays are plaguing the plant amid an already fraught U.S. labor market. Both companies are a bottleneck, for the production (TSMC) and design (NVIDIA) of Graphical Processing Units, which are the leading computer chip for training large language models. The U.S. as the largest computer market today, is attempting to spread out the capacity in event of a crisis, but France may have to take more drastic action to get a seat at the AI table. Recent funding for AI by French billionaire Xavier Neil may have something to do with that.